Claim a Tax Deduction on Australian Art Before 30 June 2025

If you're a small business owner or art collector in Australia, this is your last chance to take advantage of the Instant Asset Write-Off for eligible Australian artwork purchases.

Until 30 June 2025, businesses with an annual turnover under $10 million may be able to instantly deduct the full cost (up to $20,000) of original Australian artworks purchased for their workspace. That includes art for office walls, reception areas, meeting rooms, and client spaces.

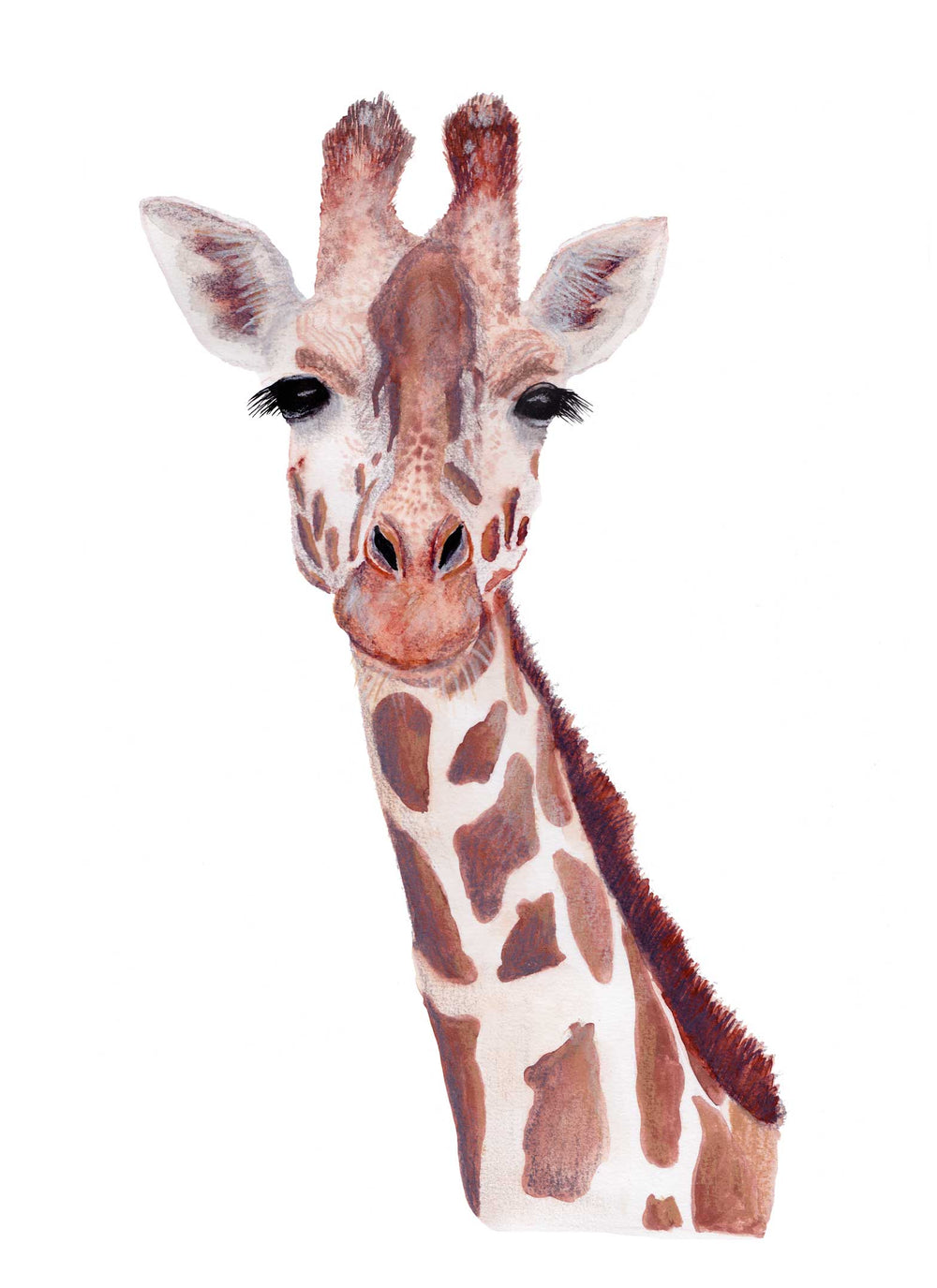

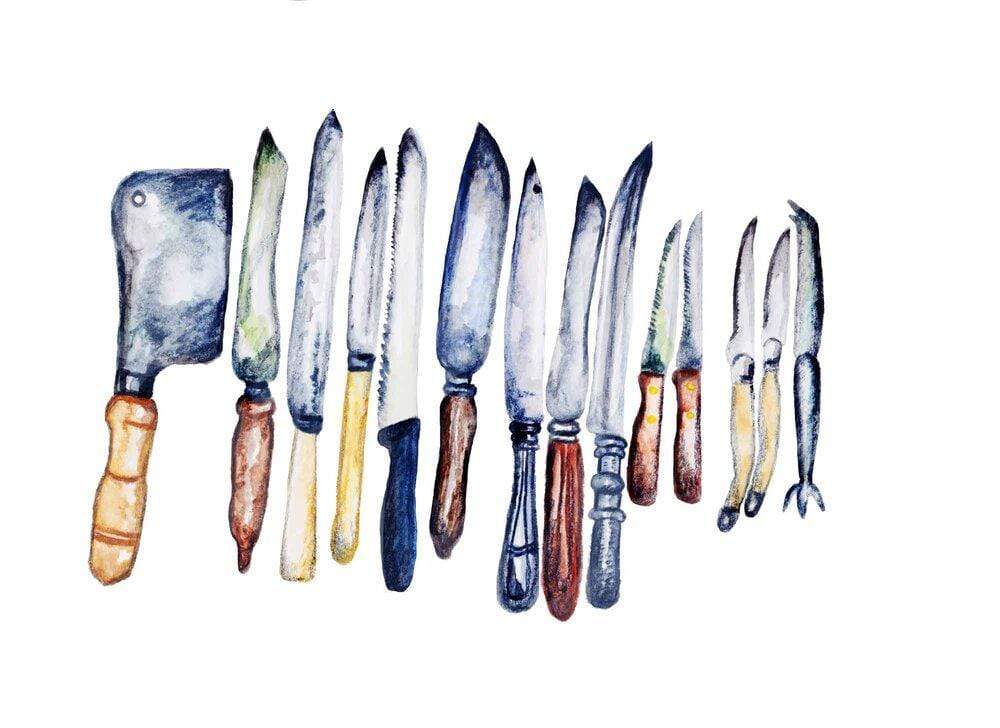

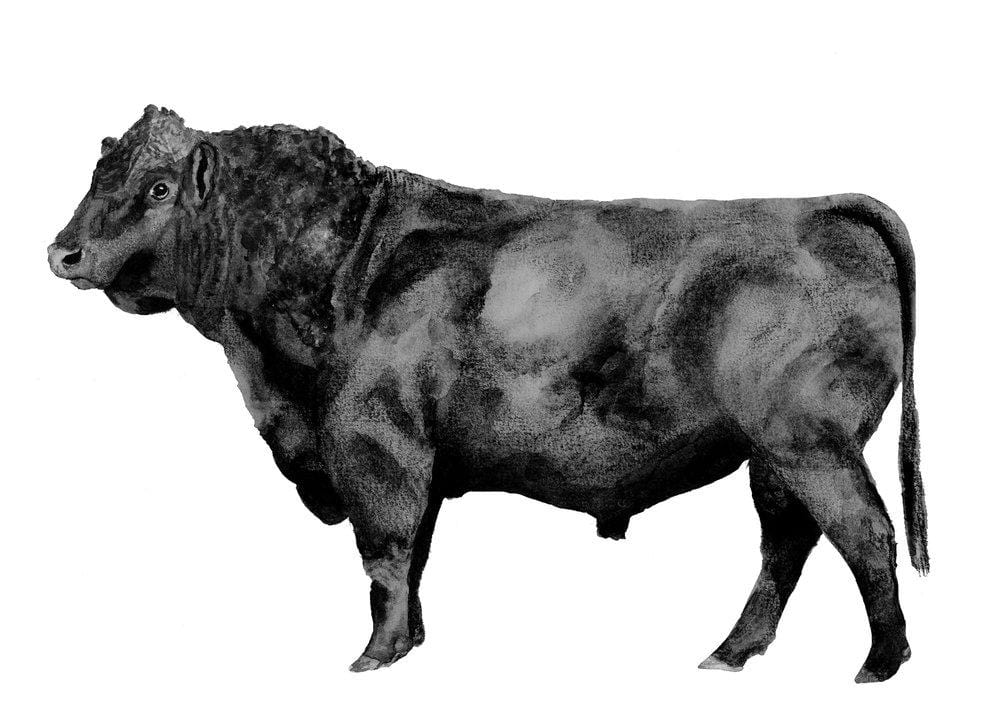

Browse the Curated Collection

Discover a selection of fine art prints and original landscape paintings by Australian artist Carina Chambers — perfect for professional spaces seeking soul, colour, and connection.